Packaging MEA editor Ben Daniel takes a closer look at the GCC economy through the World Bank Report released recently. GDP is expected to grow by 2.6% in 2019 and accelerate to 3% in 2020

GCC: As we all head towards a hot and scorching summer, business could slow down as we approach the end of Q2 and beginning of Q3. That said, Packaging as an industry in the region has been going through a slow down in consumer demand. As for F&B and personal care products, this slow sown has reflected down to converters and their supliers as well.

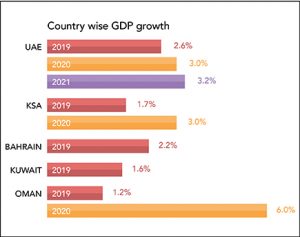

However, we are all in for some good news and pleasant growth hoping that the World Bank report turns to be precise. Growth in the Gulf Cooperation Council (GCC) region is expected to increase from 2.0% last year to 2.1% in 2019, before accelerating to 3.2% in 2020 and stabilizing at 2.7% in 2021. The report commends ongoing reforms made towards improving the business environment in the region. However, to achieve more sustainable growth, the GCC countries need to support fiscal consolidation, economic diversification, and increase private sector-led job creation, especially for women and young people.

United Arab Emirates

United Arab Emirates

The UAE is expected to be among the fastest-growing Arabian Gulf economies this year with a projected 2.6 per cent expansion on the back of continued infrastructure spending and economic stimulus, the World Bank said.

The gross domestic product of UAE, the Arab world’s second-largest economy after Saudi Arabia, is projected to accelerate to 3 per cent in 2020 as the country “pushes infrastructure investments ahead of Dubai’s Expo 2020”, the Washington lender said in its bi-annual Gulf Economic Monitor report released on Wednesday. UAE output will speed up to 3.2 per cent by 2021 supported by the government’s economic stimulus plans, hosting Expo 2020, and improved growth prospects in trading partners, it said.

Like the GCC associates, the UAE has been expanding its economy with a view to reduce its dependence on petroleum and natural gas for revenue, to withstand a decline in the energy market like the subsidence of oil prices in 2014, which have since rebounded to about $75 per barrel.

The country has launched several initiatives at federal and emirate levels to boost non-oil GDP including easing visa restrictions, reducing corporate fees and enhancing the business-friendly environment that has attracted millions of expatriates. In 2018, Abu Dhabi announced a Dh50 billion three-year economic stimulus package to kick-start its economy, while earlier this year, Dubai rolled out a record budget ahead of Expo 2020.

Saudi Arabia

Saudi Arabia

The GDP of Saudi Arabia, Opec’s top oil exporter, is projected to grow by 1.7 per cent in 2019, as higher government spending offsets the impact of oil production cuts implemented in the first half of 2019 by Opec and non-Opec oil-producing nations.

“It should then recover to over 3 per cent in 2020 as oil production cuts are reversed, and as large infrastructure projects generate positive spillovers to private sector growth,” the lender said.

“The potential boost from the diversification investment spending would continue supporting growth in 2021 and the medium term,” the bank said.

Despite the steady progress, major reforms to attract investors and boost competitiveness, the Gulf states need to continue on the path of fiscal consolidation, economic diversification and increasing private sector-led job creation, especially for women and young people, the World Bank said.

“Working closely with the GCC, we have seen strong political will from some countries to achieve their country vision plans with real, tangible outcomes on the ground,” said Issam Abousleiman, World Bank regional director for the GCC. “But economic transformation is a long-term endeavour, requiring steadfast, predictable implementation. While the road ahead is challenging, it is possible and we are committed to taking this journey together.” Source: World Bank