A new report from PCI Films Consulting forecasts that flexible packaging demand in the Middle East and Africa (MEA) will expand at 5% per year over the next five years.

The UK-based consultancy expects the market to benefit from inward investment and an expansion in mass food processing.

In 2013, the MEA market flexible packaging market totals almost $4bn, said PCI.

But per capita consumption in the Middle East and Africa runs at only $3, compared with Europe’s US$30, giving “huge potential for future growth”, said the research firm.

Multinational brands are increasingly drawn by national initiatives in the region to promote economic growth and develop infrastructure, according to PCI Films Consulting.

Nigeria is pinpointed at the most dynamic market, with flexible packaging demand up by about 12% per year over the past five years.

But smaller markets such as Tanzania and the UAE have also seen above average growth.

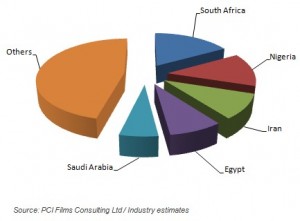

Five countries – South Africa, Nigeria, Iran, Egypt and Saudi Arabia – currently account for more than half of the region’s total consumption.

The report identified the following growth factors for flexible packaging in the MEA:

- A rapidly growing young population and increased urbanisation.

- Increased investment in food production and processing across both regions.

- Significant investments in new flexible packaging converting capacity.

- Increased availability of locally produced and competitively priced base substrates.

- Growth in modern retailing and increased penetration of pre-packed foods.

But both the Middle East and, especially, Africa remain net importers of flexible packaging, largely from Europe but increasingly from India and China.

Leading European and American owned multinational converters have virtually no local production capability in the region, according to the report.

Substantial intra-regional trade includes the use by Saudi and UAE converters of films produced as part of their country’s downstream petrochemical diversification.

Also Indian entrepreneurs have successfully established thriving converting operations in Nigeria and the UAE.

The region’s flexible packaging industry remains very fragmented. Of over 350 converters identified by PCI, the top 20 players account for only around 40% of production.